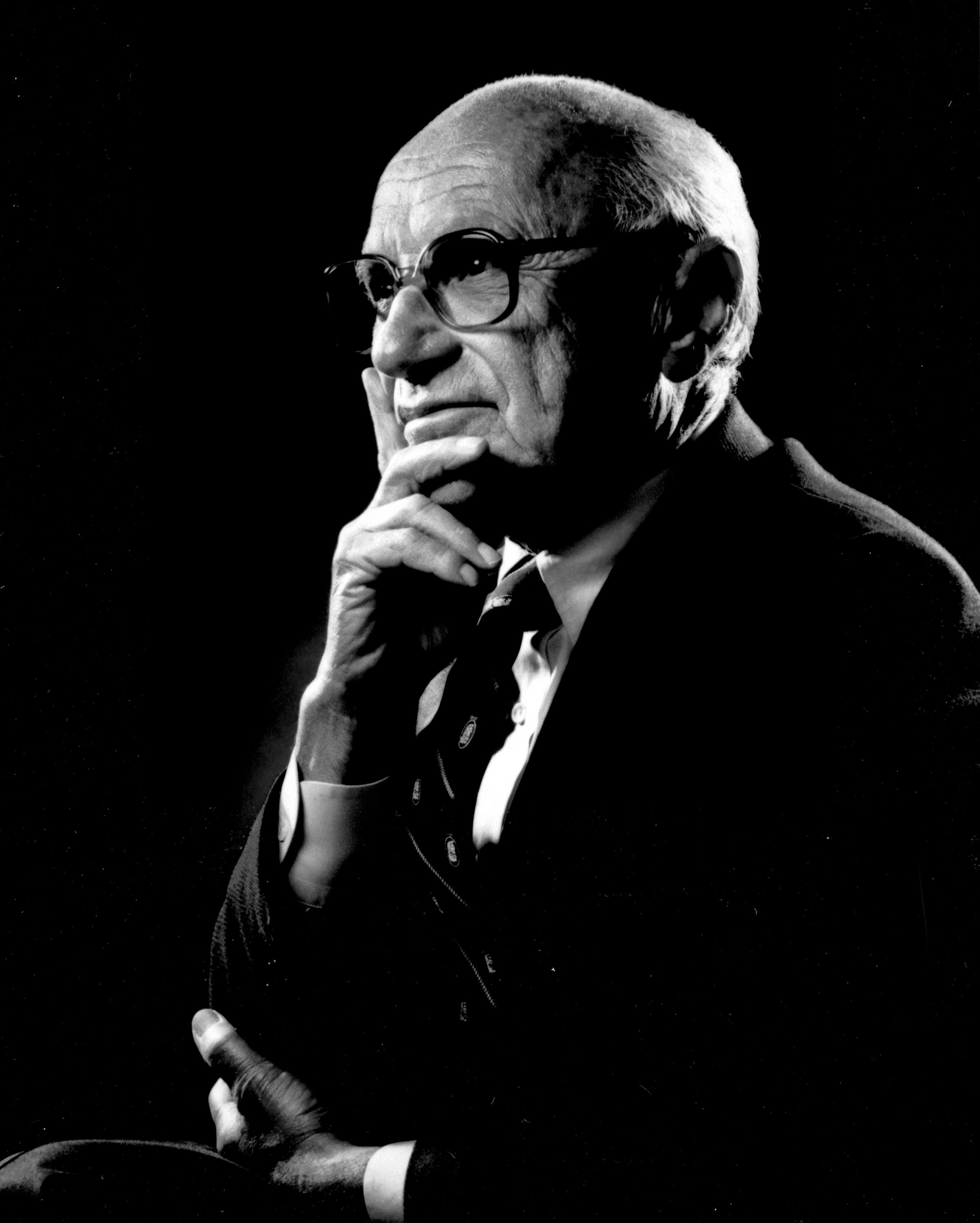

Milton Friedman

Milton Friedman is an extremely accomplished economist who lived from 1912 to 2006. He was born in New York and earned a B.A. at the age of 20 from Rutgers University. He then earned his M.A. from the University of Chicago and his Ph. D. from Colombia University. In 1951 he received the John Bates Clark Medal for outstanding economic achievement under the age of 40. He served as an advisor to President Richard Nixon and was the president of the American Economic Association in 1967. He was also awarded the Nobel Prize for his achievements in the fields of consumption analysis, monetary history and theory, and stabilization policy. His research and views in monetary theory even impacted the Federal Reserves response to the global financial crisis of 2007-2008 after his death.

In 1945 he wrote Income from Independent Professional Practice along with Simon Kuznets. In this book they argued that doctors were able to charge higher prices because of reduced competition from the difficulties of entry into the medical positions caused by licensing. In 1957 he wrote A theory of the Consumption Function which argued against the Keynesian view that households adjust consumption based on their current income, but instead they base it on "permanent income" or income they expect to have for the next few years.

In 1962 he wrote Capitalism and Freedom, a book in which he argued for free markets, including the need for freely floating exchange rates. During this summer I worked for the Chicago Mercantile Exchange, and during breaks I would read interesting articles about the history of the exchange and its products. I learned about Friedman reading one of these articles, which was on the creation of the FX futures market at CME. Many people were against the idea of creating an exchange for FX because of Bretton Woods, which essentially kept a fixed exchange rate. Leo Melamed was the chairman of CME, and he wanted to expand the exchange into offering exchange rate futures. This was a revolutionary idea as many in the financial world thought futures should stay in agriculture and was not appropriate elsewhere. However, Melamed met with Friedman and hired him to write a paper for $7,500 explaining the importance of the FX sector in the exchange and also why Bretton Woods would fail and further advocated for a free moving FX market. With this paper Melamed was able to convince CME board members to follow through in creating this market and also used the paper to show government officials what his plan was. I found it to be a rather interesting coincidence that the alias I was assigned had a major impact on the company I interned for and was praised in an article, sponsored by the company, which I read only a few months ago. However, he was a very influential economist so maybe this coincidence is not that surprising after all.

Sources:

- http://openmarkets.cmegroup.com/12346/fx-futures-currency-trading-revolutionized-finance

- http://openmarkets.cmegroup.com/4360/how-milton-friedman-changed-foreign-exchange

- http://www.econlib.org/library/Enc/bios/Friedman.html

- https://en.wikipedia.org/wiki/Milton_Friedman

In 1945 he wrote Income from Independent Professional Practice along with Simon Kuznets. In this book they argued that doctors were able to charge higher prices because of reduced competition from the difficulties of entry into the medical positions caused by licensing. In 1957 he wrote A theory of the Consumption Function which argued against the Keynesian view that households adjust consumption based on their current income, but instead they base it on "permanent income" or income they expect to have for the next few years.

In 1962 he wrote Capitalism and Freedom, a book in which he argued for free markets, including the need for freely floating exchange rates. During this summer I worked for the Chicago Mercantile Exchange, and during breaks I would read interesting articles about the history of the exchange and its products. I learned about Friedman reading one of these articles, which was on the creation of the FX futures market at CME. Many people were against the idea of creating an exchange for FX because of Bretton Woods, which essentially kept a fixed exchange rate. Leo Melamed was the chairman of CME, and he wanted to expand the exchange into offering exchange rate futures. This was a revolutionary idea as many in the financial world thought futures should stay in agriculture and was not appropriate elsewhere. However, Melamed met with Friedman and hired him to write a paper for $7,500 explaining the importance of the FX sector in the exchange and also why Bretton Woods would fail and further advocated for a free moving FX market. With this paper Melamed was able to convince CME board members to follow through in creating this market and also used the paper to show government officials what his plan was. I found it to be a rather interesting coincidence that the alias I was assigned had a major impact on the company I interned for and was praised in an article, sponsored by the company, which I read only a few months ago. However, he was a very influential economist so maybe this coincidence is not that surprising after all.

Sources:

- http://openmarkets.cmegroup.com/12346/fx-futures-currency-trading-revolutionized-finance

- http://openmarkets.cmegroup.com/4360/how-milton-friedman-changed-foreign-exchange

- http://www.econlib.org/library/Enc/bios/Friedman.html

- https://en.wikipedia.org/wiki/Milton_Friedman

I read some of Friedman's work on consumption - it was called the permanent income hypothesis - during my first quarter in graduate school. In the second quarter we read a different paper by him about rules versus discretion with regard to fiscal and monetary policy. He was for rules, since he claimed that policy makers make errors of the sort we discussed in class today.

ReplyDeleteFriedman is an iconic economist, no doubt, but we will not be discussing his work in our class.